In the Navigation pane click on the +/- sign to the left of the Sole Trade box.

The program prepares and prints both forms sa103F and sa103S.

sa103f

sa103s

Please read the HMRC documents sa103f-notes sa 103s-notes

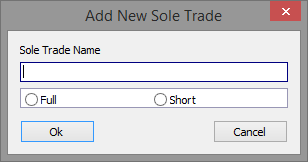

To set up a new trade click on Add New Sole Trade, enter the sole trade name and hit the OK button. Otherwise click on an existing trade.

Note:

The input screens differ and the examples below show the inputs for sa103F.

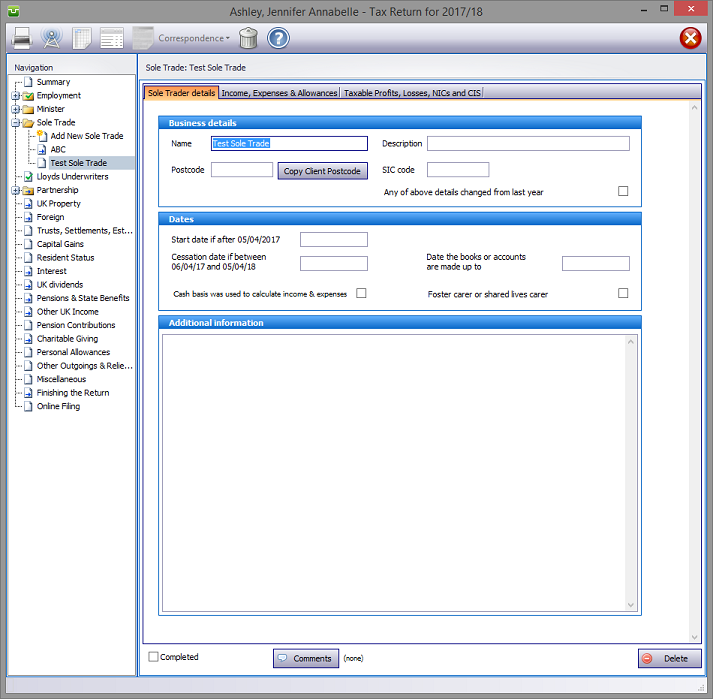

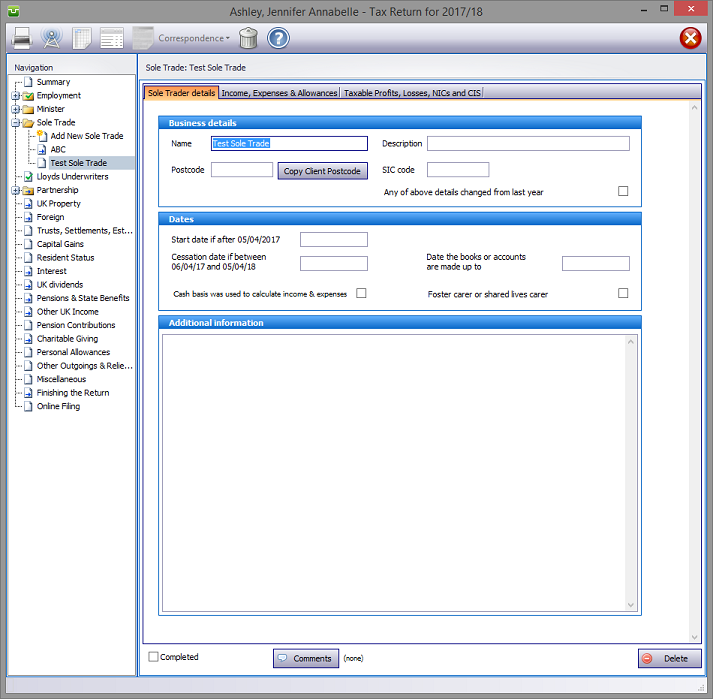

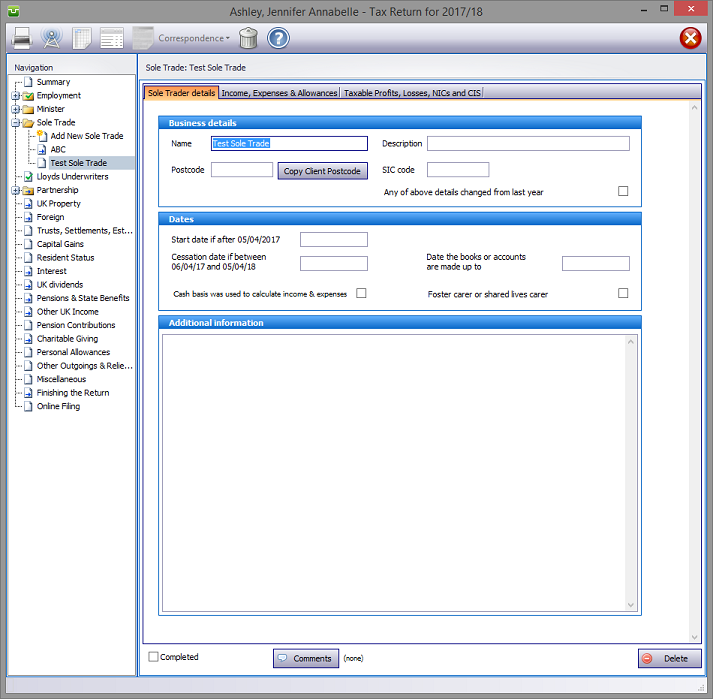

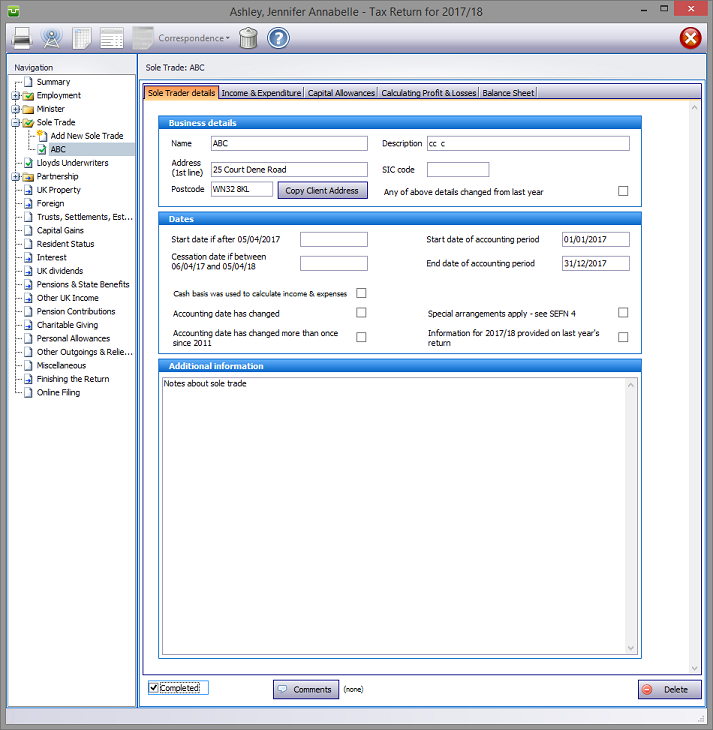

Sole Trader details

Whilst entering data is intuitive and self explanatory, please ensure that

Note:

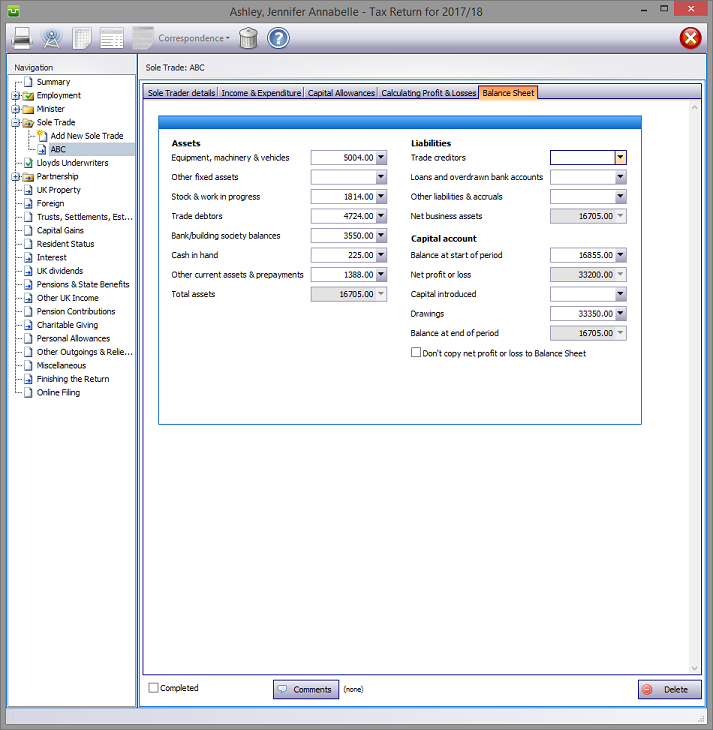

Income and Expenditure, Capital Allowances, Balance Sheet

Either enter all relevant details manually or directly from an accounting program. Although, presently we only support data imported via the Clipboard using the Standard Name Format we plan to work with other formats in the future.

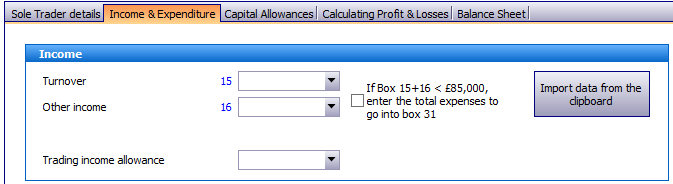

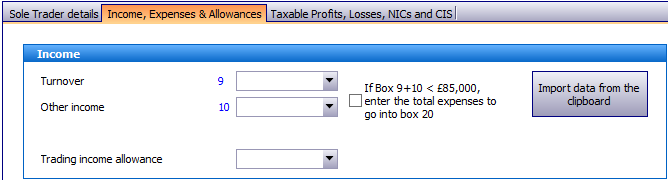

From your accounting program, which can export accounting data via the Standard Name Format, click on the Import data from the clipboard button.

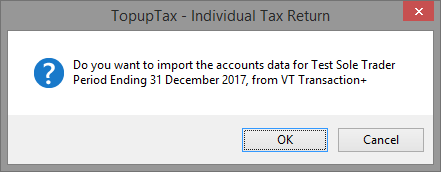

If you use Visual Transaction for your bookkeeping and preparing VAT returns you will be aware that as from April 2019 these may only be submitted to HMRC via software compatible via MTD (Making Tax Digital). Although there are a number of products which will link VT to HMRC, using Absolute Tax Filerprovides a straightforward means of accomplishing this.

If necessary, enter disallowable expenses manually then enter the full details of the capital allowance calculations or check the Enter totals only tick box to access the Totals boxes.

If the income of the business is below the relevant threshold (£85,000 in 2017–18) you need only enter turnover, other income and total expenses. Proceed by checking the If Box 14+15 or Box 9+10 <£85,000 etc. tick box. This greys out all inputs except boxes 14 and 15 and opens an expenses total box which is not otherwise visible.

sa103f

sa103s

Note the Trading income allowance box in each of the above screens. Where the entry here is no more than £1,000 (the total income of the trade before deductions) it will be disregarded in calculating tax liabilities.

sa103f

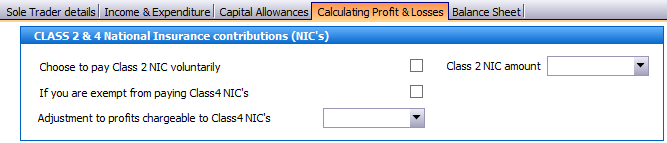

Calculating Profit & Losses, Losses, Class 4 NCI's

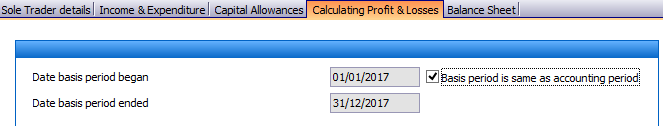

Enter the basis period dates and complete all other entries as required. Checking the Basis period is the same as accounting period tick box on the Calculating Profit & Losses tab duplicates the data on the Sole Trader details tab.

Although a balance sheet may not be required the program will automatically fill the Net profit or loss box in the Capital account on the Balance Sheet tab unless the Don't copy net profit or loss to Balance Sheet tick box is checked to suppress this feature. Where there is no balance sheet failing to check this box will result in an online filing rejection.

From 6 April 2016 Class 2 NICs are to be included in the trading and partnership pages and tax computations. HMRC have a digital record of class 2 NICs which they use in their calculations of liability. Unless you ensure that you enter the correct figures your calculations won't agree with HMRC's.

The entries need to be made on the Calculating Profit & Losses or Taxable Profits, Losses etc or Trading tabs for pages SA103F, SA103S, SA104F or SA104S.

Since HMRC allows us access to its database it should be possible automatically include this data in our applications.

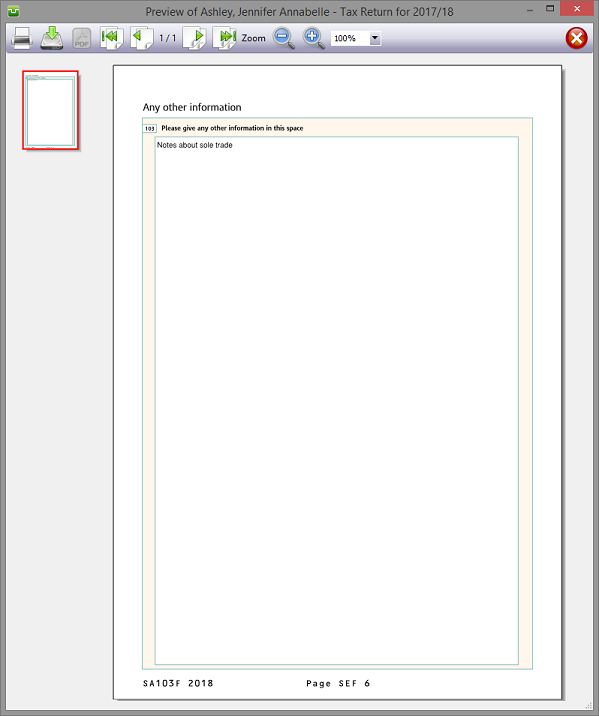

Entries made on the Additional Information area will be printed in box 102 on page SEF6 of form sa103F (overflow report on form SA103s) Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

Finishing

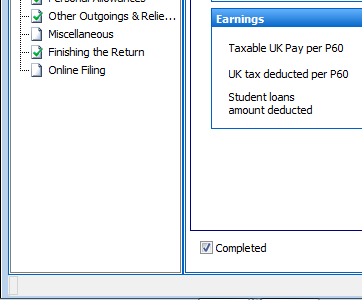

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes | Helpsheets | ||||||

| sa103f-notes | Self Employment full | hs220 | More than one business | hs229 | Information from your accounts | hs238 | Revenue recognition in service contracts UITF 40 |

| sa103s-notes | Self Employment short | hs222 | How to calculate your taxable profits | hs232 | Farm and stock valuation | hs252 | Capital allowances and balancing charges |

| hs224 | Farmers and market gardeners | hs234 | Averaging for creators of literary or artistic works | ||||

| hs227 | Losses | hs236 | Qualifying care relief |

Copyright © 2025 Topup Software Limited All rights reserved.